When starting a farm, or even when already farming, a farmer needs to understand the costings and financial concepts of farming.

The idea of farming, after all, is to make a profit.

The most important concepts to consider are gross income, costs of production, gross margin, net income and whole-farm income.

Gross Income of a Farm

Costs of Production

Some costs that have an impact on the farmer’s income can be controlled, while others cannot. For example, farmers cannot always control the price they receive for their products, so the best option is to reduce the costs of production. Production costs for farming can be classified into variable costs and fixed costs.

Variable costs

Variable costs are short-term costs such as seed, fuel and lubricants, fertilizer, hired labour (wages), electricity, irrigation water, herbicides and insecticides and packaging material.

Fixed costs

Fixed costs are costs that stay the same regardless of the size of the farm. Examples of fixed costs are capital costs of buying farm machinery (e.g.tractor), permanent labour (salaries) and land rent. From a management perspective, high fixed costs usually put pressure on the profitability of a farm and should be managed carefully. A reduction in fixed costs, without affecting production, could increase profits.

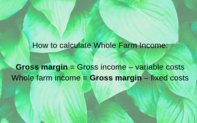

Gross Margin

A simple tool to analyse farm performance is the determine the gross margin. The gross margin is calculated simply by subtracting variable costs (seed, feed, fuel etc.) from the gross income. If a higher gross margin is generated from a specific crop in comparison with another (e.g. maize versus sunflower), then more of that crop can be planted.Enterprise Profit

Whole Farm Income

The net income of your farm can be calculated in two ways: Firstly, by combining the gross margins for each farm enterprise (e.g. the gross margin for maize and the gross margin for sunflowers) and then deducting the fixed costs. Alternatively, by estimating enterprise profit for each of the farm enterprises and adding them up.

The final income represents the profit of the whole farm. Whole farm income measures the economic strength of the business and indicates how much money is available to cover family expenses, taxes and to reinvest in the farm, such as buying or renting more land.

Source Water Research Commission